ASGN helps commercial and government businesses realize their digital innovation and transformation goals. Our industry knowledge, and qualifications get us in the door, while our investments in our clients’ future growth and success support our growing market share. Today, we consistently invest in six core areas including: leadership; recruiting; training & skill development; internal artificial intelligence tools; partnerships; and our client’s AI roadmaps. Together, we are empowering a smarter future and unlocking the full potential of our clients’ products and people.

Providing Cutting Edge AI Solutions

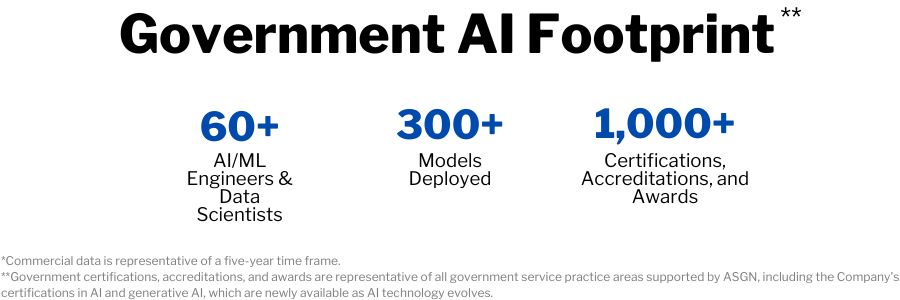

ASGN has over 8,000 customer relationships. In our Commercial Segment, we offer services in digital innovation, modern enterprise and workforce mobilization to large enterprises and Fortune 1000 companies. In our Federal Government Segment, we provide technology, science and engineering solutions to the Department of Defense, intelligence community and federal civilian agencies. Within our digital innovation and technology services, respectively, artificial intelligence (AI) is increasingly growing in interest and remains an area of our core qualifications and skillset. Check out some case studies of our recent work in AI.

Interested in learning more about our AI services and solutions in action? Check out these links on some of our recent work in Artificial Intelligence as well as review Apex Systems’ and ECS’ artificial intelligence pages.

Voices of our Leadership

Watch as John Heneghan, President of ECS, discusses Artificial Intelligence.

Interested in learning more about AI? Read more from John Heneghan about How ECS Empowers Agencies to Harness AI’s Full Potential.